“Uptober’s” legacy was put to the test towards the end of last week when US President Donald Trump threatened to impose 100% tariffs on crucial Chinese technology products. The crypto market nosedived immediately after the announcement, with Bitcoin (BTC) briefly crashing to as low as $101,000 on some exchanges.

In the following days, though, the bulls reclaimed much of the losses, and now the big question is whether the asset is ready to soar to a new all-time high during this cycle.

More Room for Growth?

As of this writing, BTC trades well above $115,000, representing a 3.5% increase on a daily scale and a substantial resurgence from the local low. Many analysts believe the worst is over, while some, like Alex Becker, think this could have been the actual “start of the bull market.”

He argued that the market has been quite “boring” lately and that the crash put a “zesty sauce” that could bring some necessary dynamics to the sector. Becker claimed that the collapse was nothing more than an “overreaction” to Trump’s announcement, describing it as “the most manipulative dump in the history of crypto.” According to him, BTC may reach a new historical peak as early as this week, suggesting that “selling right now could be the stupidest thing you could ever do.”

The veteran trader Peter Brandt also chipped in. He assumed that BTC, as well as some leading altcoins like ETH, XRP, and XLM, remain in a good position to attack fresh tops.

For his part, X user Ted told his 213,000 followers that the primary cryptocurrency could reach a new ATH if it reclaims the crucial resistance level of around $117,500.

Exploring Some Indicators

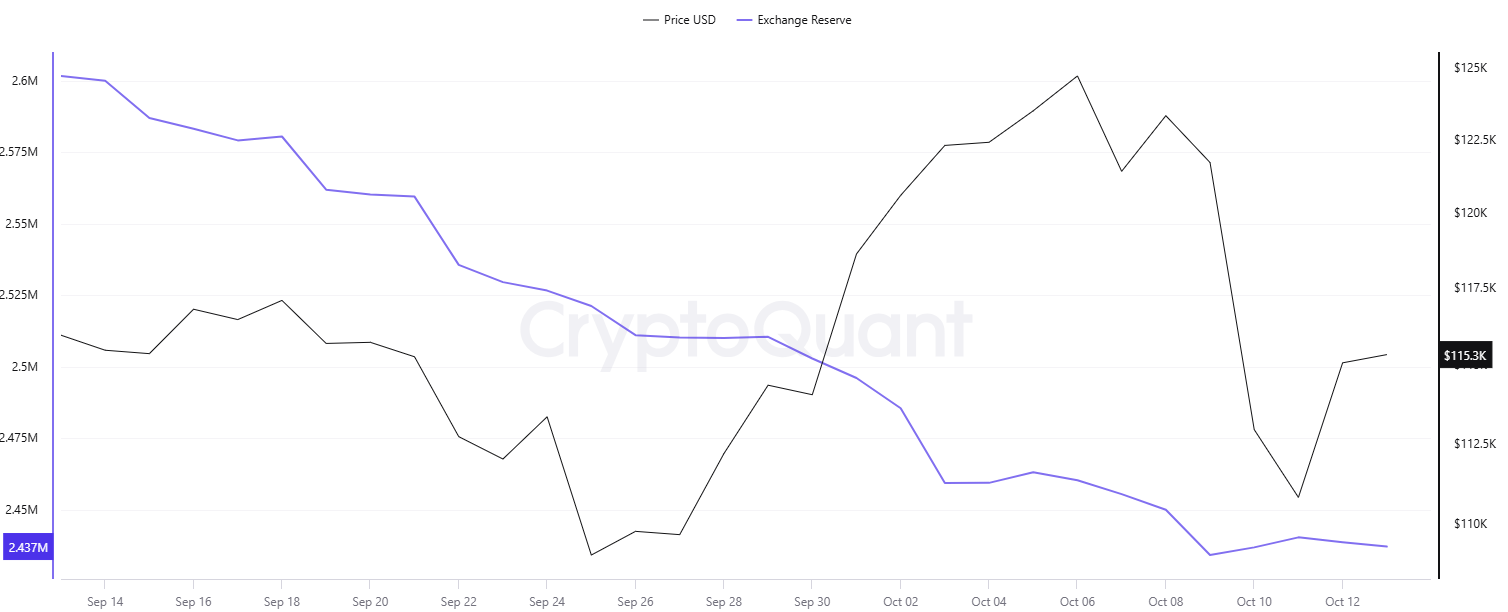

Multiple important metrics, such as BTC’s exchange reserve, support the bullish theory. CryptoQuant’s data indicates that the amount of BTC stored on crypto platforms recently dropped to a seven-year low of approximately 2.43 million assets.

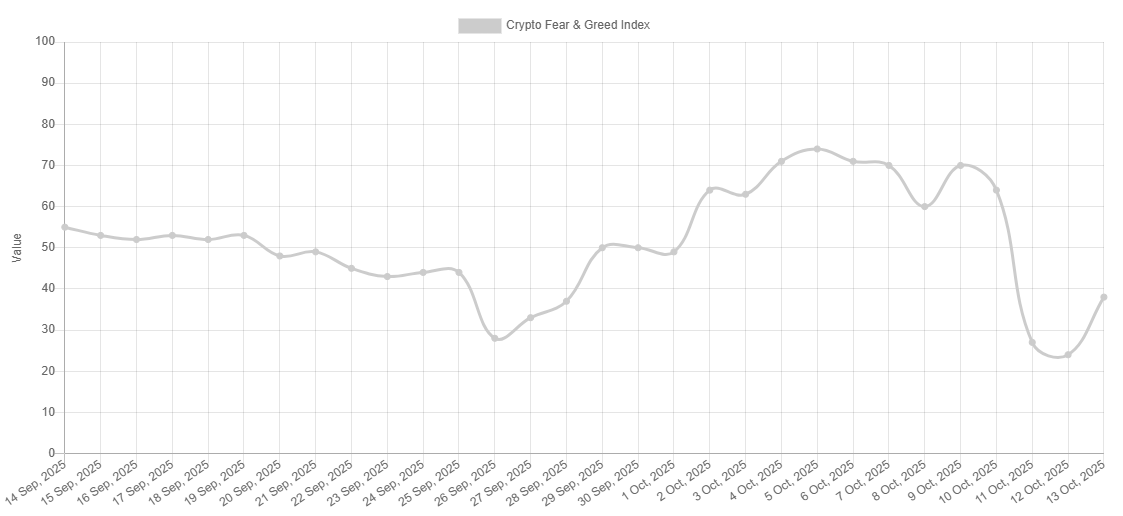

Next on the list is the popular Fear & Greed Index, which measures the overall market sentiment across investors. On October 12, it plunged to 24, the lowest point since April this year, while currently it is set at 38, which is again “Fear” territory.

This development signals that many market participants show signs of panic and pessimism. However, the crypto market is an unusual one, and it often moves against the crowd’s expectations. This is why Warren Buffett’s timeless principle – to be greedy when others are fearful and fearful when others are greedy – has become increasingly relevant in the volatile sector.

The post Top Bitcoin (BTC) Price Predictions Following the Crash: New ATH in Sight? appeared first on CryptoPotato.