Bitcoin’s adverse price movements continued on Sunday as the asset dived once again to a fresh six-month low of $93,000 before it staged a minor recovery.

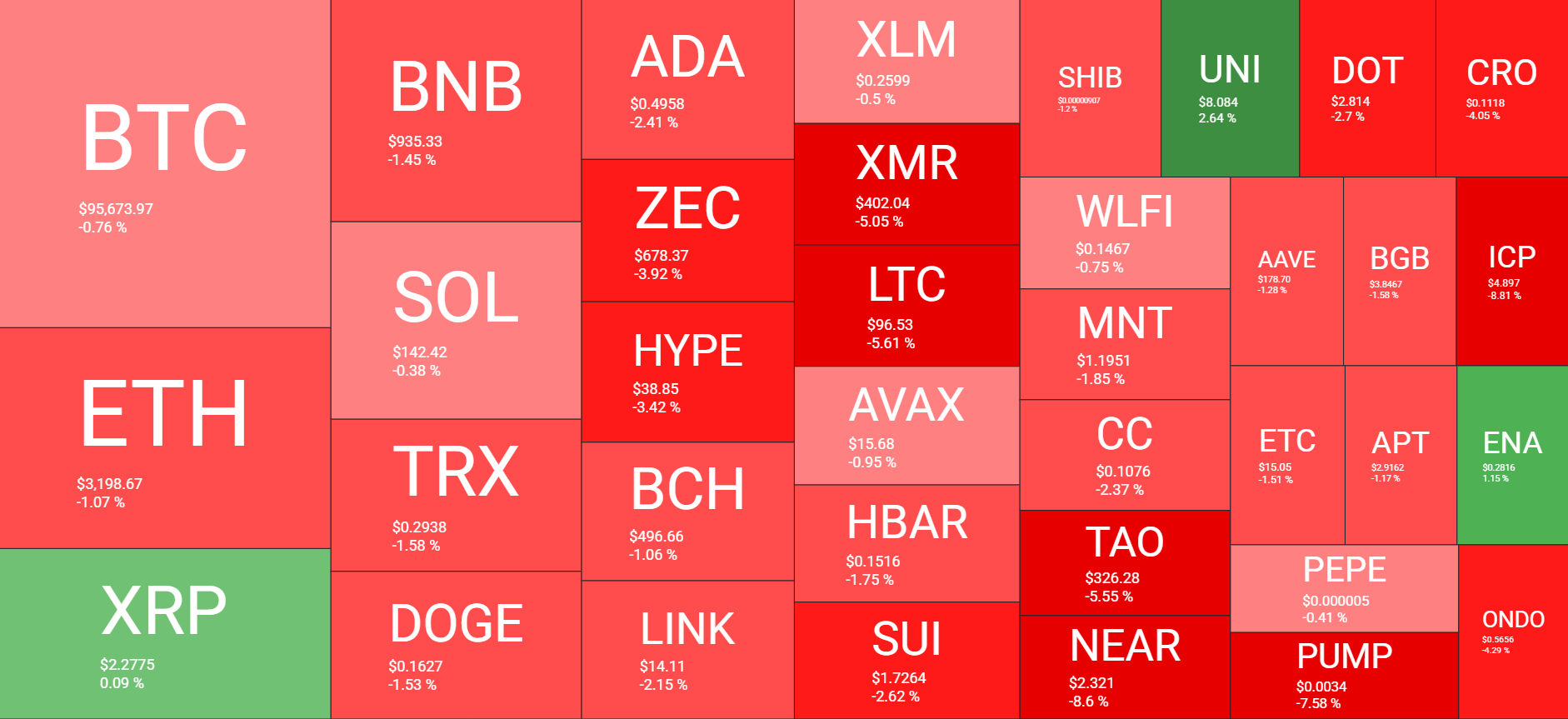

Most altcoins are in the red today, with ETH sliding to $3,200, while XMR, LTC, ICP, NEAR, and a few others have posted notable price losses.

BTC Rebounds From $93K

It was just a week ago when positive developments coming from the US drove the primary cryptocurrency to just over $107,000. However, that rally from $104,000 was short-lived, and the subsequent correction has been quite painful.

At first, BTC returned to $102,000, it bounced off briefly, but headed further south as the business week progressed. Friday saw the most significant price decline when the cryptocurrency plummeted to $94,000 for the first time since May.

The bulls finally intercepted the move and pushed the asset to almost $97,000 on Sunday. Sideways trading followed for most of the weekend, until Sunday afternoon. At the time, BTC’s landscape worsened once again and dipped to another six-month low of $93,000.

It has recovered a few grand since then and now sits close to $96,000. However, market observers are adamant that the overall BTC structure has changed, and it has entered a new type of bear market.

For now, though, its market cap remains just inches above $1.9 trillion on CG, while its dominance over the alts settled at 57.2%.

Alts Bleed

Ethereum also fell hard yesterday, dumping below $3,100 for the second time in just a few days. Despite bouncing to $3,200 now, ETH is still 1% down on a 24-hour scale. BNB, SOL, TRX, DOGE, ADA, BCH, and LINK have marked similar losses.

HYPE and ZEC are down by over 3%, while XMR, LTC, TAO, NEAR, PUMP, and ICP have charted price declines of up to 9%.

There are a few altcoins in the green, but with very modest gains, such as UNI and ENA.

The total crypto market cap has experienced another $40 billion decrease daily and is well below $3.350 trillion on CG.

The post These Altcoins Bleed Out Heavily, BTC Rebounds From a Drop to $93K: Market Watch appeared first on CryptoPotato.