Bitcoin continues to bleed, printing new local lows as the market fails to find strong support. The broader structure has broken down, and sellers remain in control after a series of distribution moves near the highs. Despite oversold signals creeping in, the lack of a proper futures capitulation keeps risk to the downside open.

By Shayan

The Daily Chart

On the daily timeframe, BTC has officially broken below the long-standing ascending channel that held price action for months. After the 50-day moving average crossed below the 200-day moving average, forming a death cross, the price accelerated downward.

Support levels around $100K and $86K were easily breached, and BTC is now moving toward the next demand zone near $76K. The RSI is also sitting deep in oversold territory, but there has not been a sharp reversal candle or volume spike that typically follows capitulation. Therefore, more downside could be expected in the short term.

The 4-Hour Chart

Zooming into the 4-hour chart, the trend has been locked inside a clean descending channel. However, BTC broke below the lower boundary recently, showing strong momentum from the sellers. Minor attempts to bounce have been weak and short-lived, leaving their marks as candle wicks only.

Any retest of the $85K zone may now act as resistance, as it has been broken to the downside. With the RSI hovering near 20 in oversold territory and showing multiple failed recovery attempts, short-term momentum remains clearly bearish unless a deviation back into the channel with strong volume materializes.

Sentiment Analysis

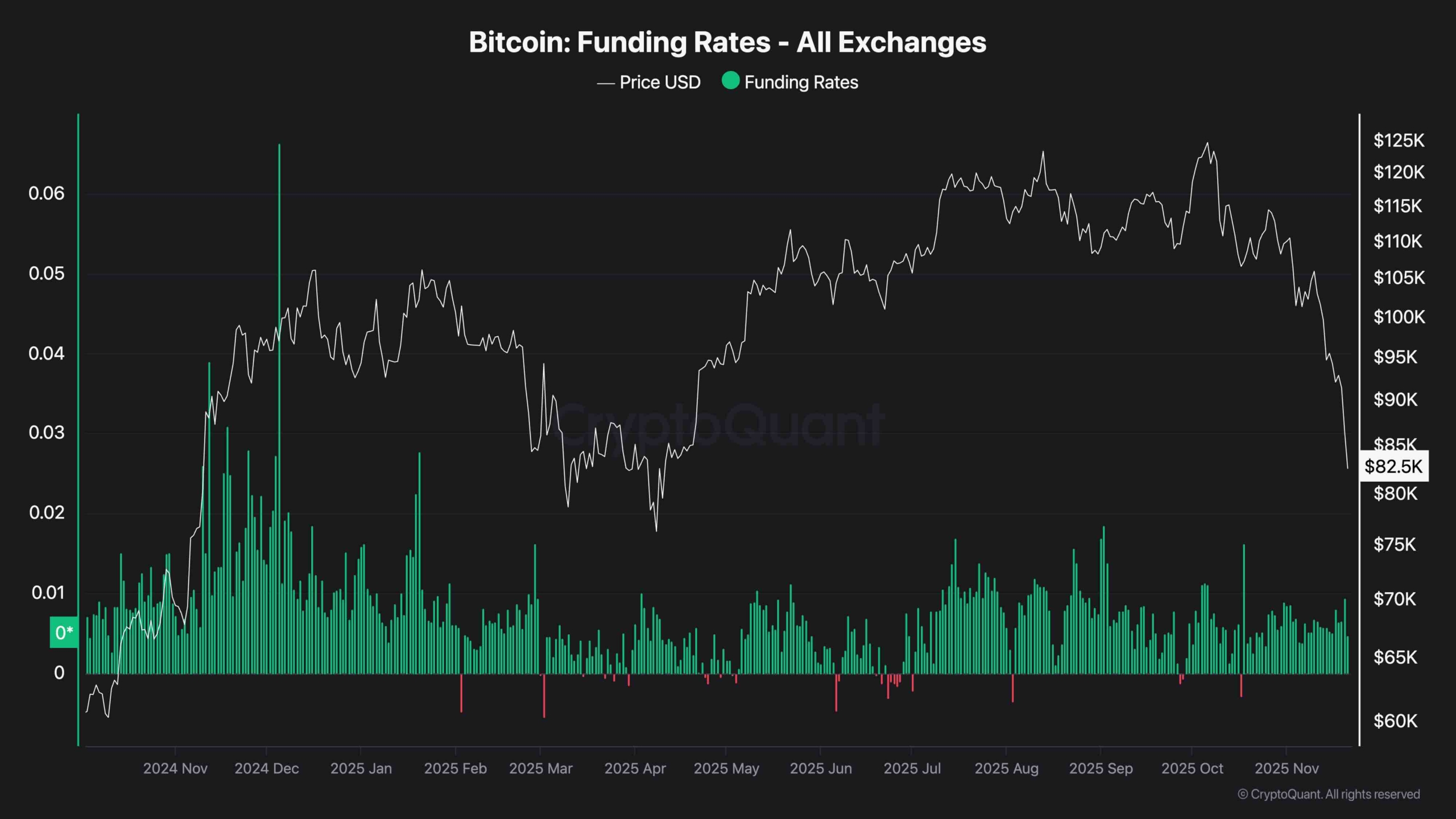

Funding Rates

Funding rates across exchanges are still hovering in positive territory, despite the aggressive drop in price. This disconnect shows that many traders are still holding long positions, potentially waiting for a bounce.

It’s an important signal: the market has not gone through full liquidation or capitulation yet. A true bottom in Bitcoin is often marked by negative funding rates and a sharp spike in liquidations. Until that happens, downside pressure could persist, and any relief rallies might be sold into.

The post Bitcoin Price Analysis: Will BTC’s Brutal Sell-Off Stop After Drop Below $81K? appeared first on CryptoPotato.