After BTC topped out at $50.5k, the short-term technicals began to turn cautious and slightly bearish as 4-hour, and daily momentum slowed and started to trend lower.

Considering Bitcoin has rallied more than 72% from $29.2k to a local high of $50.5k in just 5 weeks, it’s healthy to see a near-term pullback to build the structure. The $30k to $40k trading range’s breakout target between $50k to $52k has been reached, ideally setting BTC up for a near-term cool-off period before the next major move.

The Critical Support Zone to Hold

Bitcoin price closed below near-term support at $48.1k, signaling downside risk over the next few days. The next key level of support the bulls need to protect is the 200-day moving average at $46k.

This is critical for the bulls as bitcoin price is still in the validation phase of confirming bull market continuation. It is crucial to protect the 200-day moving average this week (weekly close), and ideally, push higher heading into the weekly close to print the third weekly close above the 21-week and 200-day moving average.

If the bitcoin price can hold the green zone between $48.1k to $46k, BTC could prepare another attempt to retest resistance at $50k for a breakout higher. If BTC struggles to hold the 200-day, we can expect downside risk to $43.9k to $42k. Closing below the 200-day will turn technicals bearish and weaken the price structure.

On-chain Metrics Showing Near Term Caution

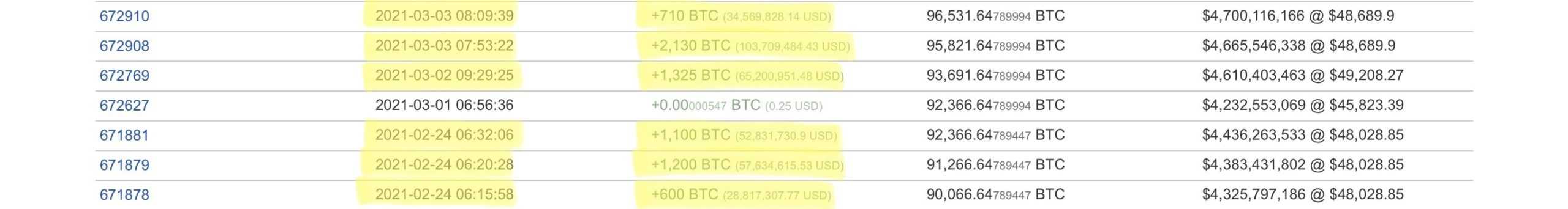

Near-term on-chain metrics are signaling some caution, especially after the third-largest whale transferred 1,500 BTC to Coinbase and a slight uptick in long-term holders realizing some profit.

The 1,500 BTC inflow from the third-largest whale shouldn’t be a concern as it still holds 93.5% of its total BTC holdings. Previous purchases were made between $48k to $53k, so this could either be breaking even, realizing a small profit, or selling BTC to buy altcoins.

So far, the increase in long-term holders selling is nowhere close to the 2018 bear market exit liquidity. It would be concerning to see this trend continue sharply, but at the moment, it’s not surprising to see some distribution from whales after a 72% rally.

In addition, the supply coming on the market is being absorbed by large buyers. Today, Coinbase registered a net outflow of 940 BTC, even with a 3.6% pullback and a slight uptick in long-term holders selling. Notably, the outflows exceed inflows by a ratio of 1.64. Coinbase outflows came in at 2399 BTC with inflows of 1459 BTC, indicating a large US buyer could have stepped in to buy the dip.

Ideally, the bulls should avoid this scenario at all costs by protecting $46k and staging another attempt to break resistance at $50k. So far, the supply is being absorbed by buyers, so once supply is fully absorbed, this will make the task of breaking $50k much easier.

Accumulation Continues: Microstrategy Buys More

Near term, the charts might not look the best, but BTC bulls celebrated again as Michael Saylor, the CEO of Microstrategy (ticker: MSTR), announced an additional purchase of 3,907 BTC at an average cost of $45.2k. The company now owns 108,992 BTC, just over 0.5% of the total supply of Bitcoin.

As we reported, BTC’s pullback to $44k last week saw consistent spot exchange net outflows with spot reserves declining, which can potentially be connected to Microstrategy’s $177 million purchase of the largest cryptocurrency.

Market participants will be watching BTC closely to see if the price can hold the critical 200-day moving average. So far, the on-chain metrics are showing continuing accumulation with large Coinbase outflows that look favorable for Bitcoin.

It remains to be seen if the BTC price can continue holding critical support at $46k for the rest of the week. Overall, despite near-term technicals weakening, the mid to longer-term outlook remains positive according to the improving fundamentals, technicals, and on-chain metrics.