Bitcoin continues to slide deeper into the correction phase, with the price now entering the lower boundary of the broader demand region. The market is approaching an area where long-term buyers historically begin accumulating, yet momentum remains decisively bearish in the short term.

Technical Analysis

By Shayan

The Daily Chart

BTC has extended its decline into the $90K–$92K demand block, completing a full sweep of the October liquidity pocket. The asset is currently interacting with the lower half of a multi-week Fair Value Gap, where previous macro re-accumulation phases have formed.

Both the 100-day and 200-day moving averages continue to slope downward above the price, confirming that buyers remain under pressure. The most recent breakdown below $96K produced no meaningful reaction, suggesting that momentum is still with the sellers for now.

What is becoming more notable, however, is the growing separation between the price and its mean trend. The RSI has reached deeply oversold historical levels, matching the conditions seen during the mid-cycle retracements of April and August. If buyers manage to defend the $89K–$92K band, this zone could form the base of a multi-week consolidation, potentially marking a higher-timeframe accumulation zone before the next structural reversal.

Confirmation of strength would only come if the market reclaims the $98K–$100K region. Failure to do so keeps the door open toward the lower demand zone near $85K.

The 4-Hour Chart

On the lower timeframe, the asset continues to move within a bearish formation, with each lower high forming closer to the support boundary. This compression often appears in the later stages of a downtrend.

Bitcoin is testing the $90K–$92K support box for the second time, and the reactions remain weak. A clean bullish reversal above $96K would indicate a shift in short-term momentum, allowing a corrective rally toward the unfilled inefficiency at $102K.

If sellers maintain control, a deeper sweep of the $88K liquidity layer becomes likely. The structure remains vulnerable, but the clustering of lows within this region suggests that buy orders may be absorbing supply quietly, a common feature of early accumulation phases, even if the price volatility persists.

On-chain Analysis

By Shayan

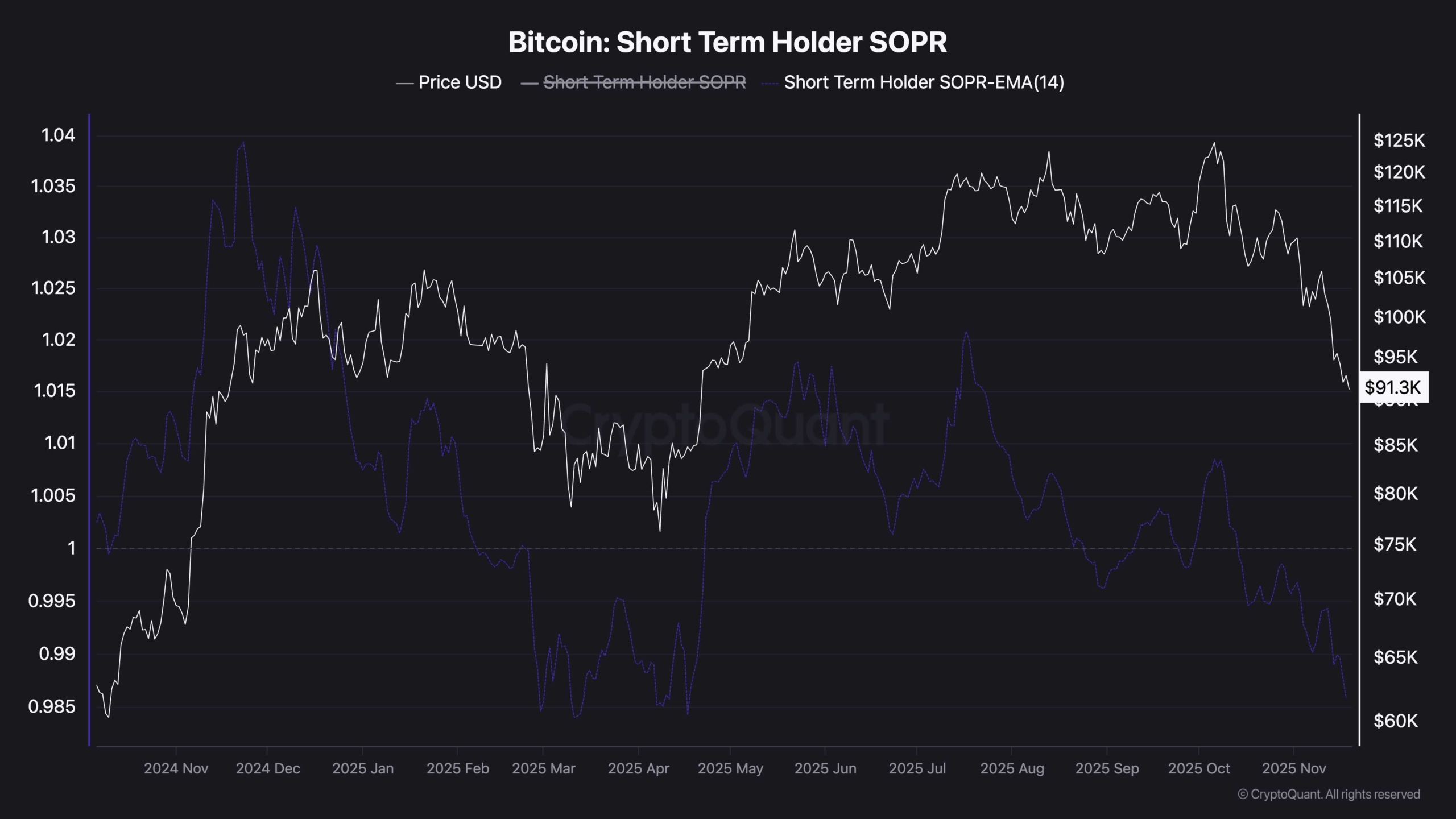

Bitcoin is entering one of the most intense short-term capitulation phases of this cycle. The Short-Term Holder SOPR has dropped sharply toward 0.97, confirming that short-term holders are now realizing losses on a persistent basis. SOPR has remained below the critical 1.0 threshold for several weeks, forming a clear capitulation band.

Historically, such periods represent fear-driven liquidations rather than informed long-term distribution. This behavior tends to emerge not at the beginning of corrections but near their later stages, when weak hands are flushed out and stronger holders begin absorbing supply.

While this does not guarantee an immediate reversal, it reflects an important structural shift. The ongoing loss-taking by short-term investors resets cost bases and clears out speculative positioning, allowing the market to transition toward a healthier foundation for the next macro move.

If price stabilizes above the $89K–$92K zone while SOPR remains suppressed but begins curling upward, it would indicate that capitulation has reached exhaustion and that accumulation is underway. A sustained breakdown of this zone, however, would open the path toward a deeper sentiment reset before recovery can develop.

The post Bitcoin Price Analysis: Is BTC Heading Below $90K Again as Sellers Remain in Control? appeared first on CryptoPotato.