Binance Coin (BNB) is nearing a key technical level as market attention turns to whether the price can break out of a long-standing range.

The asset is trading within a rising structure on the higher timeframes, and analysts are watching for any clear move above the current resistance.

BNB Trades Near Major Resistance

BNB is trading around $1,181 at press time, down slightly over the past 24 hours and nearly 10% lower on the week. Even with the dip, the price remains within a rising channel that has developed over multiple years. The upper boundary of this channel sits near $1,400, a level that has previously caused reversals.

Analyst Jonathan Carter described this point as a “make-or-break moment” for BNB. He mapped out longer-term targets at $1,800, $2,500, and $4,500, provided the current resistance area is cleared. These levels are based on previous price reactions and key horizontal zones.

#BNB Ascending Channel About to Unfold?

Binance Coin is testing the upper border of the ascending triangle on the 2W chart

Long-term target levels: $1,800 → $2,500 → $4,500

Make-or-break moment

pic.twitter.com/X2AZpahvvo

— Jonathan Carter (@JohncyCrypto) October 14, 2025

The 50-period moving average is rising below the current price, and the RSI remains neutral, allowing room for continued movement if momentum builds.

Furthermore, BNB found support at $1,069.75 during the recent pullback. It has since rebounded and is now trading above $1,140. This level has become important as price continues to hover within a range between $1,120 and $1,200, which appears to be acting as a decision zone.

Market watcher Skull noted,

“Buyers still in control with price action showing resilience in this zone.” He added, “If we break $1,200 again, next stop gonna be new highs.”

So far, the level has held, but another test of $1,200 may be needed to confirm momentum.

Derivatives Market Signals Trader Interest

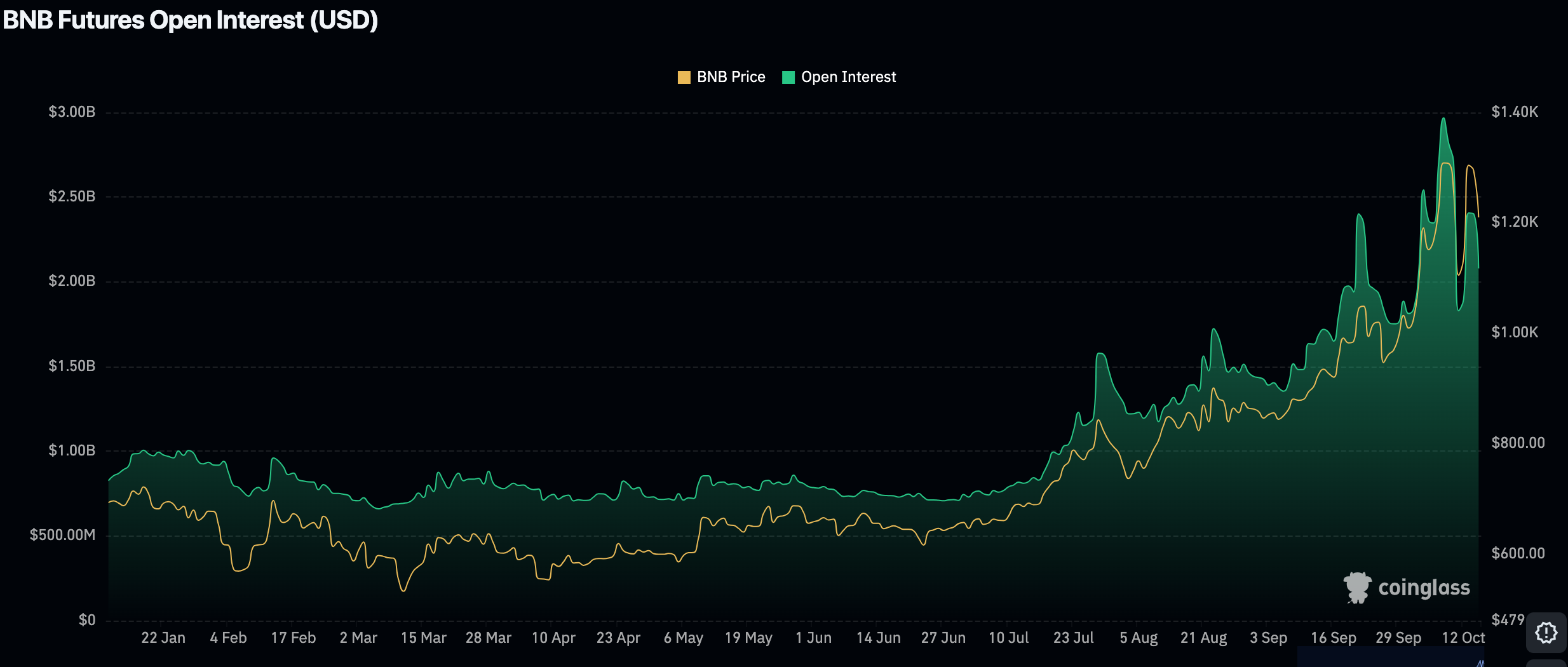

According to Coinglass, BNB futures open interest is just under $2.5 billion. This figure has grown steadily since mid-July, tracking alongside price gains. The rise in open interest reflects growing participation in the BNB market.

While open interest has pulled back slightly from its recent peak, the overall level remains high. Traders appear to be maintaining exposure, and market positioning still leans toward a continuation, provided BNB stays above the key support levels.

The post BNB Price Chart Flashing Bullish Signal: $4,500 Ahead? appeared first on CryptoPotato.