Ethereum has failed to sustain momentum above the $4,000 mark, and the price action is now breaking down toward key support levels. The broader structure remains corrective, and with both price and sentiment leaning bearish, ETH appears to be entering a more vulnerable stage. Volatility remains low, but downside pressure is gradually building.

Technical Analysis

By Shayan

The Daily Chart

On the daily timeframe, ETH has been rejected from the descending channel’s higher trendline and is now heading toward a key demand zone near $3,400. The asset has also failed to reclaim the 100-day moving average and is now hovering above the 200-day moving average, located around $3,300.

The $3,500-$3,300 zone is a critical one that has been defended before, but the RSI at 38.68 and the lower highs on each bounce suggest that bulls are losing control. Unless ETH can bounce decisively from this area, a breakdown below it, the 200-day moving average, and the channel’s lower boundary could lead to the next leg down toward the $3,000 zone in the coming weeks.

The 4-Hour Chart

The 4H chart paints a clearer bearish picture. The price is on the verge of sweeping up sell-side liquidity just below $3,700. A break below this level could confirm weakness and create a new lower low, pointing to the formation of a clear bearish structure.

The RSI is also nearing oversold conditions, but hasn’t yet printed any bullish divergence. After the rejection from the $4,100–$4,200 area and the clear shift in momentum, a drop toward the $3,400-$3,500 demand zone and another test of the lower boundary of the channel is highly probable. A breakdown below this area could lead to more than a 10% decline, dragging the price into the next support block around $3,000, unless a fake breakdown occurs.

Sentiment Analysis

Coinbase Premium Index

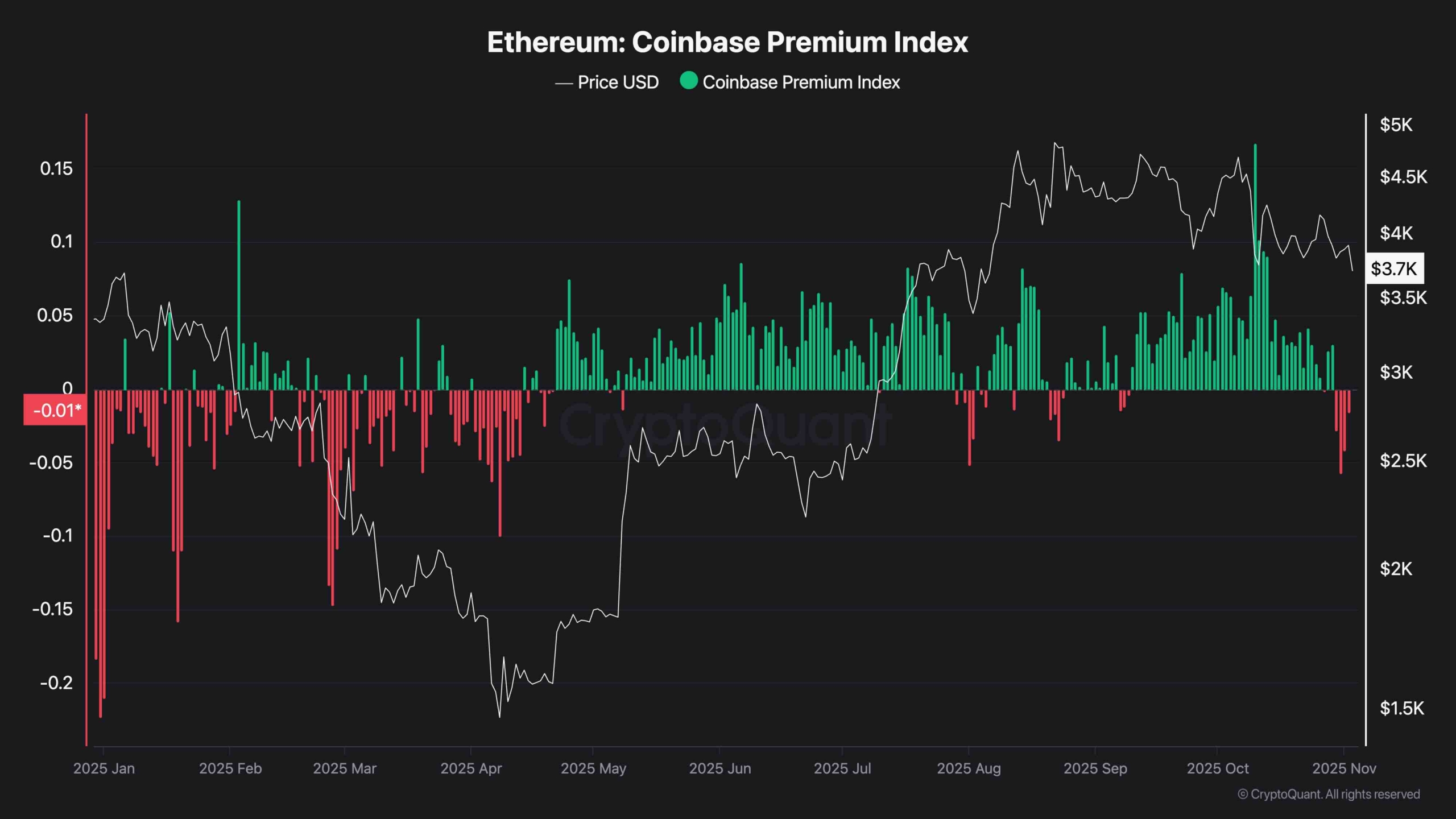

Sentiment has started shifting negatively again. The Coinbase Premium Index flipped deeply negative, indicating that US-based buyers are no longer bidding aggressively. Historically, extended periods of negative premiums tend to coincide with distribution phases or deeper pullbacks.

Overall, the lack of demand from US markets is usually one of the early signs of a deep correction, and combined with weak technical structure, it keeps the outlook bearish unless fresh catalysts emerge.

The post Ethereum Price Analysis: Lose This Level and $3K ETH Comes Into View appeared first on CryptoPotato.