Ethereum continues to show strength, currently trading around $4,670 as it edges closer to the midline of its ascending channel. The market has maintained a steady recovery since late September, but signs of local exhaustion are beginning to appear, suggesting a potential short-term pullback before another push higher.

Technical Analysis

By Shayan

The Daily Chart

On the daily timeframe, ETH remains firmly within its rising channel structure, supported by the 100-day moving average near $3,900 and the 200-day around $3,000. The price is approaching the $4,800 resistance zone, a key level that has repeatedly capped rallies over the past couple of months.

The RSI has also climbed to 62, reflecting healthy momentum, though not yet overheated. A breakout above $4,800 could open the path to testing the psychological $5,000 level and beyond, while failure to sustain current levels could lead to a retest of the lower boundary of the ascending channel and even the critical $4,000 demand zone, which would be crucial for the investors to hold to sustain the bull market.

The 4-Hour Chart

The 4-hour chart shows early bearish divergence between price and RSI, indicating weakening momentum as ETH tests the key $4,700-$4,800 resistance zone. Yet, a small bullish Fair Value Gap (FVG) has formed near $4,600, which could attract short-term retracement and support before continuation.

If the buyers defend this gap and reclaim control, the next upside target remains $4,800. However, losing this level may trigger a deeper correction toward $4,200, where a strong demand zone and the neckline of the recent inverse head and shoulder pattern are located.

Onchain Analysis

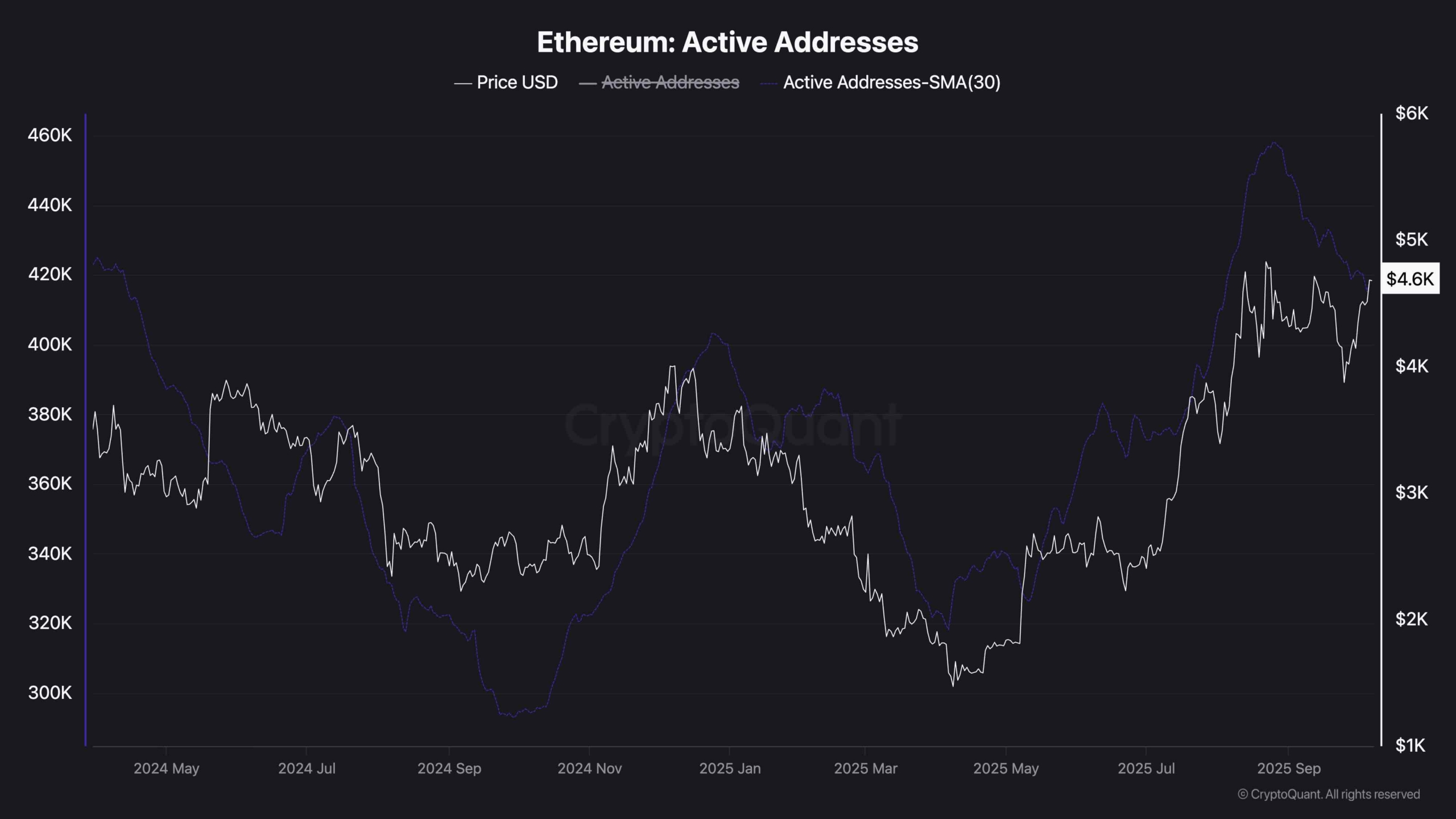

While Ethereum’s price has been rebounding strongly and looks ready to rally higher, on-chain activity tells a slightly different story. The number of active addresses has been dropping slightly recently, even as the price climbs. This shows a short-term disconnect between network participation and market performance.

For this uptrend to remain sustainable, active addresses need to rise alongside price, confirming genuine user engagement and on-chain demand. A continued decline in activity could signal weakening fundamentals, making it harder for ETH to sustain momentum above the $4,700–$4,800 resistance zone.

The post Ethereum Price Analysis: Worrying Fundamentals Might Halt ETH’s Rally to $5K appeared first on CryptoPotato.