Ethereum is trading at around $3,900 at press time, posting a slight gain over the last 24 hours. The past week has seen a 3% pullback.

Despite the dip, market watchers say conditions remain favorable, backed by long-term chart structures and exchange activity.

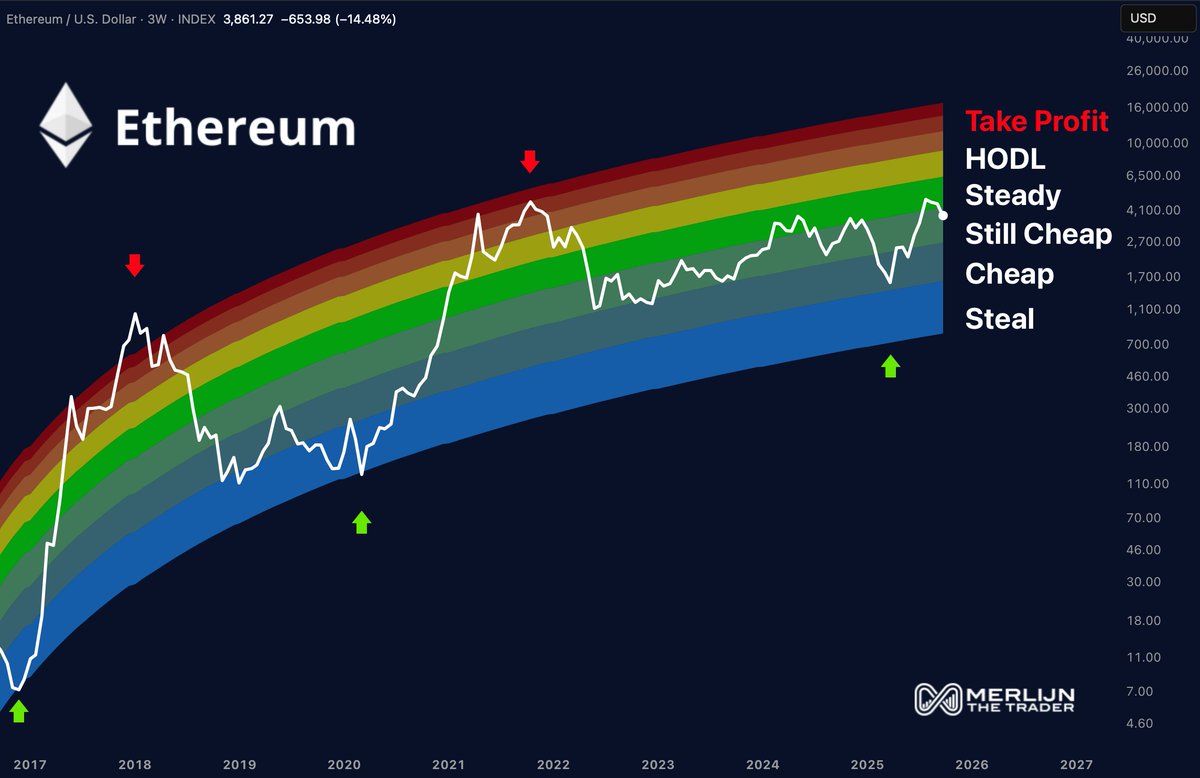

Ethereum Holds Green Zone in Rainbow Model

The Ethereum Rainbow Chart, shared by Merlijn The Trader, places ETH in what the model labels as the “Still Cheap” zone. This band sits below the historical “HODL” and “Take Profit” areas, which have marked overheated conditions in previous cycles.

Merlijn wrote,

“Every major bottom has the color blue. Every top is red… Right now? ETH is still in ‘Still Cheap’ territory.”

According to the chart’s historical behavior, Ethereum is not showing signs of being overpriced and may have room to advance.

Breakout Confirmed After Two Years of Rejections

Ethereum recently broke above a resistance level that had held since November 2021. After facing multiple rejections in past cycles, ETH closed above the trendline and has since returned to test it from above. That retest has so far acted as support. Said EtherNasyonaL,

$ETH Retest completed, now It’s time to run.

The downtrend from the November 2021 peak has broken and is in a retest phase.

Ethereum is no longer in a “rejection” phase, but in a “retest” phase.

Next page price discovery. pic.twitter.com/utrmUlHHYX

— EᴛʜᴇʀNᴀꜱʏᴏɴᴀL

(@EtherNasyonaL) October 22, 2025

The move signals the end of a long consolidation period. If the price holds above the retest zone, the chart points to a possible continuation into higher levels.

Ethereum is trading just below a key level last reached before the 2020 rally. Then, as now, the price stalled at resistance after months of sideways movement.

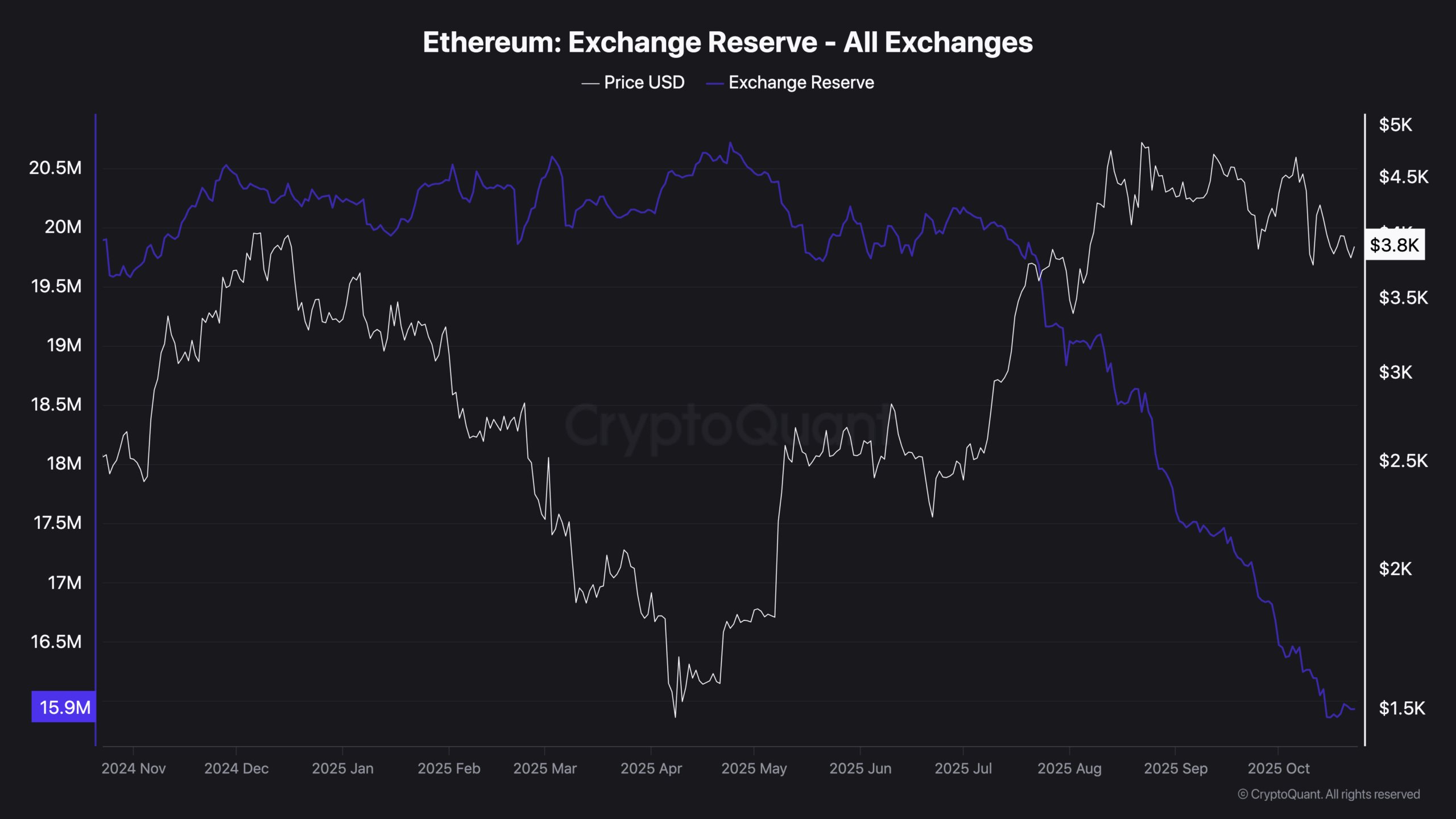

Exchange Balances Fall as Supply Drops Off Market

According to CryptoQuant, ETH reserves held on centralized exchanges have dropped to 15.9 million, down from over 20 million in late 2024. The steady decline reflects movement away from exchanges, often linked to long-term holding, staking, or cold storage.

Despite the supply shift, the price has held near recent highs. This suggests demand remains steady, or that sellers are not active at these levels. Reduced exchange balances have historically appeared during early stages of accumulation phases.

Short-Term Levels to Watch

In the shorter time frame, analysts remain cautious. Ali Martinez suggests ETH could move back toward $3,700 if it fails to reclaim higher levels. Resistance remains at $4,100, a zone that multiple traders are tracking for confirmation of bullish continuation.

Ethereum $ETH looks ready to revisit $3,700! pic.twitter.com/0UbJK0uwz7

— Ali (@ali_charts) October 22, 2025

Ted Pillows added,

“Until ETH fully reclaims $4,100 level with strong institutional inflow, I think most pumps will be retraced.”

Lennaert Snyder pointed to $3,740 as a recent bounce zone and marked $4,050 as resistance. Short-term moves remain uncertain, but the broader price structure continues to hold.

The post Ethereum Still ‘Cheap’? Rainbow Chart Says the Rally Isn’t Over appeared first on CryptoPotato.