Bitcoin is testing a key level that has previously marked the start of major market corrections. The 50-week simple moving average (50W SMA), now near $102,000, has served as a long-term support line in multiple past cycles. Its failure has often led to extended drawdowns.

As of press time, the asset was priced at $103,000, showing a modest 1% gain over the last 24 hours. Over the past week, it has declined 7%, with daily trading volume near $61.7 billion.

50W SMA and Historical Breakdown Patterns

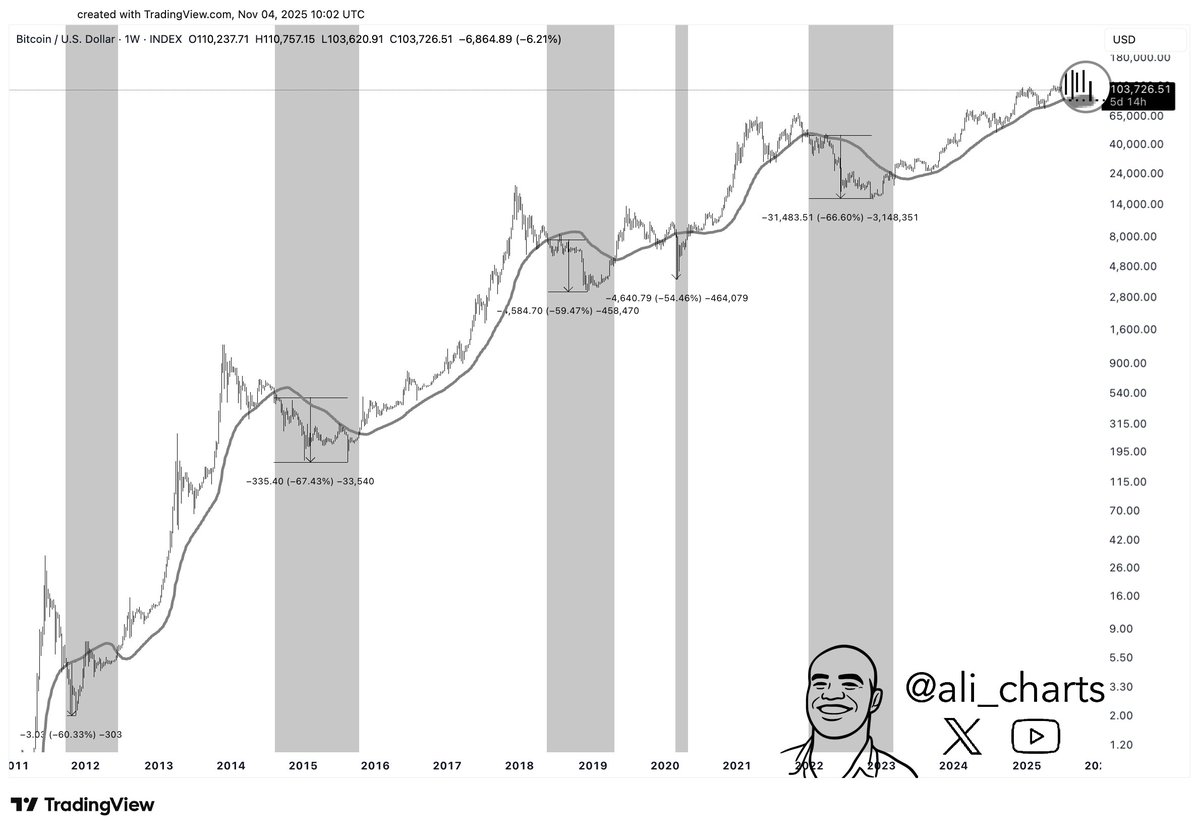

Market history shows that each time Bitcoin lost the 50W SMA, a sharp correction followed. Analyst Ali Martinez pointed to several examples where this support failed: a 50% drop in 2011, 67% in 2014, 60% in 2018, and 66% in late 2021. The 2020 crash during the COVID outbreak also saw a 55% decline after the same breakdown.

Martinez stated,

“Bitcoin has seen an average 60% drop each time it has lost the 50W SMA as support.”

Based on that pattern, a confirmed break below $102,000 could project a potential move toward $40,000. This level is now being viewed as a make-or-break area for Bitcoin’s longer-term structure.

Key Short-Term Levels and Price Reaction

Analyst Lennaert Snyder also marked $102,000 as a short-term support level to monitor. He noted that the 4-hour chart still shows an uptrend and added,

“I prefer to hold key $102,000 support to not lose the 4H uptrend.”

He also pointed to $107,100 as a key level for bulls to reclaim.

Analyst Ted observed that Bitcoin moved below the EMA-50 and emphasized the importance of the weekly close. He explained,

“A weekly close below EMA-50 means the dump is just the beginning.”

Meanwhile, key liquidity levels sit near $90,000 and $126,000, with the possibility of a drop to fill the CME gap before any recovery.

Market Structure, MACD Signal, and Open Interest

Linton Worm pointed to a confirmed bearish MACD cross and linked it to previous cycle tops. “In 2021, it predicted the crash. Now the same is happening,” he said, adding that $70,000 could be the next support to watch if pressure continues.

Meanwhile, data from Darkfost showed a sharp drop in Bitcoin open interest across major exchanges. Since October 10, open interest has declined by over $10 billion, led by Binance, which saw a $4 billion decrease. Bybit and Gate.io followed with drops of $3 billion and $2 billion, respectively. Leverage remains low, and confidence among traders appears limited as the correction unfolds.

The post History Says Bitcoin (BTC) May Fall 60% If This Key Support Fails to Hold appeared first on CryptoPotato.