Filing your crypto taxes this year? The following step-by-step guide explains how to properly report crypto earnings in the US, UK, and Europe – plus, we compare some of the best tools to automate the process, save you tons of time, and possibly money.

Key Takeaways:

- Crypto is taxed as property in most jurisdictions. This means you owe taxes only when you sell, swap, or earn crypto – not for just holding it.

- Taxable events include crypto trading, mining, staking, airdrops, and token swaps. Donations, gifts, and transfers between your own wallets are usually non-taxable.

- The US, UK, and Europe apply distinct crypto tax rules: the IRS sees crypto as a digital asset, the HMRC splits taxes into income and capital gains, the EU countries follow individual frameworks under the MiCA regulation.

- Crypto tax software such as Koinly, CoinLedger, CoinTracker, CryptoTaxCalculator, TokenTax, and others can automate reporting and save you a lot of time and funds.

Understanding Crypto Taxation

Quick Overview:

- Crypto taxes apply only to taxable events – such as selling, trading, mining, staking, token swaps, and airdrops. If you simply hold crypto, taxes are not yet owed.

- Two types of taxes: income and capital gains. Staking and mining incur income tax, the rest – capital gains tax.

Crypto taxes are financial obligations that every taxpayer must cover based on their crypto transactions within a given tax year. Tax authorities in most jurisdictions treat cryptocurrency as property rather than currency. As a result, they impose taxes on different crypto activities of citizens and residents in their country.

But what crypto activities are taxable? Most authorities classify the following activities as taxable events:

- Selling

- Staking

- Mining

- Trading

- Token swaps

- Airdrops.

This means that you pay taxes when you use decentralized finance (DeFi), non-fungible tokens (NFTs), perpetual futures trading, and various other crypto services.

Crypto services that fall under the category of taxable events are subject to either capital gains or income tax. Taxpayers incur an income tax based on their income/salary/wages, or interest earned by them. Within the crypto sphere, income taxes apply to activities such as staking and mining.

Capital gain tax applies to profits from selling a product or service. Hence, crypto users are subject to capital gains tax when they swap or sell their crypto holdings.

Every tax year, the tax authority in your country mandates that you submit a detailed tax report and pay your taxes. This report includes your crypto transactions to outline your profits, losses, and income. Note that the beginning and ending of the tax year vary from country to country.

It is important to note that you do not incur any taxation from simply holding a crypto asset. Instead, you incur a tax debt when you sell or swap the cryptocurrency for a profit. Remember that the crypto market is highly volatile.

As a result, users may record losses on their crypto investments. In such cases, tax authorities do not impose a tax on such crypto losses. Moreover, you can write off these losses and discount your taxable income.

Additionally, under most jurisdictions, users are free from taxation when they donate crypto to a non-profit organization or a charity group, give or receive crypto as a gift, or send crypto to another account they own.

With that out of the way, let’s move to how some of the major jurisdictions treat crypto taxation.

Crypto Taxes in the United States (US)

Quick Overview:

- The IRS classifies cryptocurrencies as digital assets. This means that all crypto transactions must be reported for tax purposes. Income is taxed as ordinary income and crypto gains are taxed as capital gains.

- Taxpayers have to declare crypto activity each year. The tax year is from January 1st to December 31st, but the filing deadline is April 15th.

- Use Form 8949 for sales/exchanges and Form 1040 Schedule 1 for income from mining, staking, or airdrops.

The Internal Revenue Service (IRS) is the government agency that oversees federal tax laws in the United States.

The IRS classifies cryptocurrencies (including coins, tokens, memecoins, stablecoins, DeFi tokens, and NFTs) as digital assets, putting the asset class on par with other investment vehicles, such as stocks, bonds, and debt instruments.

As a result, taxpayers are required to submit reports showing their crypto transactions during the tax year. Note that the U.S. tax year runs from January 1st to December 31st. However, the deadline to file your taxes is April 15th.

According to the IRS website, taxpayers must say YES or NO in their tax reports regarding whether they received, sold, exchanged, or “otherwise [disposed] of a digital asset.”

The website also revealed that the basis for the taxable event (its cost) depends on the type of transaction. Like most tax agencies, the IRS categorizes transactions into income and capital gains tax categories.

The regulator has various forms for different transaction types.

For example, those who sold or exchanged crypto as a capital asset should fill Form 8949, while those who receive crypto as income from hard forks, mining, and staking should fill Form 1040 (Schedule 1).

There are also forms for those who received crypto as gifts, sold crypto to customers, and for employees or independent contractors who were paid in crypto.

The U.S. tax authority also requires crypto users to report rewards from crypto airdrops, token incentive programs, referral bonuses, and other sources. These are classified as income.

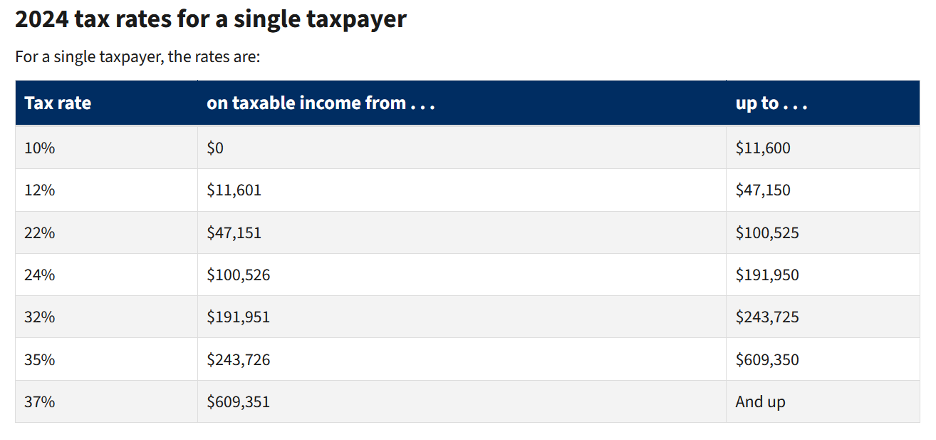

As of 2024, the IRS has implemented the following structure for its tax rate:

Crypto Taxation in the United Kingdom

Quick Overview:

- HMRC splits crypto taxes into capital gains and income tax. Capital gains tax varies between 18% and 25% on “disposals” of crypto like sales or exchanges. Income tax is between 0% and 45% on earnings through mining, staking, or salaries.

- The UK tax year runs from April 6th to April 5th.

- The filing deadlines are October 31st (paper submissions) or January 31st (online submissions) after the tax year ends.

His Majesty’s Revenue and Customs (HMRC) is the United Kingdom’s official tax authority that collects taxes from individuals and businesses. Like most tax authorities, the HMRC splits crypto taxes between capital gain tax and income tax.

Regarding capital gain tax, users must pay crypto taxes when they “dispose” of crypto assets. This applies when they sell, exchange, use crypto to purchase an item, or give it to another individual. However, this excludes gifts to their spouse, civil partner, or charity groups.

For income taxes, taxpayers are required to pay tax on interest earned on crypto holdings, staking and mining rewards, and salaries paid in crypto.

The HMRC offers a tax-free allowance. For the 2024/2025 tax year, the government implements a tax-free allowance of £3,000 on capital gains. This means that whenever a user’s total gain for the tax year is capped at £3,000 or below, they will pay no tax on their profits.

However, they must pay capital gains tax of 18% to 25% when their transactions exceed the threshold. They also pay between 0%-45% income tax rate when they earn a personal allowance above £12,570, according to the official sources.

The UK government counts the tax year from April 6th to April 5th.

Those submitting their tax reports to HMRC on paper must do so before the October 31st deadline, while those reporting online have until January 31st, both after the tax year ends.

Crypto Taxation in the European Union

Quick Overview:

- Separate countries in the EU are responsible for their own tax rules but have to abide by MiCA.

- Germany is the country with the most favorable tax rules.

- Austria, Belgium, Denmark, and France are among the countries with higher crypto tax rates.

The European Union currently has a unified crypto-focused guideline, dubbed the Markets in Crypto-Asset (MiCA) regulation.

This governs how all member states handle cryptocurrencies. However, the bloc has yet to implement tax rules determining how each member country treats crypto taxes. Currently, member states have unique tax regulations for their citizens.

Germany is regarded as the European country with the most favorable tax rules. It exempts capital gains on crypto held for over 12 months from taxpayers’ obligations. This encourages long-term holding. It also offers tax-exempt amounts that favor crypto users. Other countries with favorable crypto tax rules include Switzerland, Malta, Bulgaria, and Hungary.

Conversely, countries like Austria (a flat 27.5% rate on capital gain), Belgium (up to 33% on capital gain), Denmark (up to 53% for capital gain tax), France (a flat 30% tax rate for annual gain above €305), and Spain (between 19% and 28%) are known to have high crypto tax rates.

While most EU member states have their own crypto taxes, introducing a continent-wide crypto tax regime would be a game-changer. It would reduce confusion, making it easier for governments and taxpayers to agree on one thing. The tax rate could also be moderate —neither too high nor too low —benefiting government authorities and taxpayers alike.

Best Crypto Tax Software Tools to Use

As we mentioned in the start, using tools can help you tremendously. These can:

- Save you countless of hours.

- Save you money.

- Prevent mistakes.

- Organize all of your transactions and split them by transaction types.

- Calculate profit and loss (PnL).

- Categorize the outcome in respective tax brackets based on your current jurisdiction.

- Prepare ready-to-file reports, and even forms.

So, if you live in any of the above regions, here is a comparative list of some of the best crypto tax software available to you.

| Name | Key Pros | Price | Rating |

|---|---|---|---|

|

$49 – $199 |

||

|

$49 – $199 |

10% OFF for Cryptopotato readers

|

|

|

$59 – $3499 |

20% OFF for Cryptopotato readers

|

|

|

$49 – $499 |

||

|

$65 – $3499 |

Step-by-Step Guide to File Crypto Taxes

Here is a detailed five-step guide on how to file your crypto tax reports and submit before the tax year ends:

Step 1: Choose the Appropriate Crypto Tax Software

The first step is to select a crypto tax software. We’ve discussed five top choices with varying features, pricing, and perks, but if you want more information, we have a separate article on how to choose the best crypto tax software in 2025.

Whether you live in the U.S., the UK, or anywhere in Europe, the aforementioned software providers have the tools you need to fulfill your tax obligations.

Pro tip: check out the pricing packages and relate them to your needs. For example, if you only have, let’s say, 500 transactions, make sure the tool offers something along those lines to avoid overpaying.

Step 2: Create an Account

After choosing the tool you feel comfortable with, the next step is to create an account. Most crypto tax software providers will ask if you’re creating the account as an individual, a business, or an accountant. You will also provide details, such as your country, base currency, and the purpose for which you want to use the account.

Pro tip: most of the solutions on our list have a free tool, so use it to see if the interface fits your needs.

Step 3: Connect Your Crypto Exchanges and Wallets

The next step is to link the tax software to your account(s) on crypto exchanges and Web3 wallets.

You can connect them via an API or manually upload a CSV file.

Those using Web3 wallets, DeFi protocols, or NFTs on specific blockchains can paste their wallet addresses into the software to sync them. This way, the crypto tax software can track your transactions to provide a detailed tax report. It is vital to link all your accounts to ensure accuracy.

Pro tip: do both. First use the API, then import a CSV file. It won’t cost additional money but it’s better to be safe than sorry.

Step 4: Review Your Transactions

After linking your crypto accounts to the crypto tax software, you can review your imported transactions to easily rectify issues like duplicate transactions, uncategorized transactions, or missing purchase history. Most crypto tax software tools allow users to track their portfolios for free.

Step 5: Generate Your Tax Report

When ready to submit your tax report, you can generate and submit it to the necessary tax authority.

How Does Manual Crypto Tax Reporting Work

As you can imagine, manual crypto tax reporting is basically taking all the work that a crypto tax software does and handling it on your own.

You have to export your transactions from all the different trading venues and Web3 wallets that you use, sort them by types to determine the type of tax you incur on them, and calculate PnLs on your own.

Now, if you are a casual trader and you’ve carried out 5 trades during the tax year, this is something you can easily manage on your own, and there is absolutely no reason to pay for a tool to do it.

But if you are somewhat serious about trading or if you are a frequent flipper of trending meme coins on Pump.fun (for example), doing all of the work manually is just unrealistic. Chances are that you will miscategorize transactions, miss some transactions entirely, and mess up your PnL.

Oh, and you will spend a ton of time doing so.

Common Mistakes to Avoid When Filing Your Crypto Taxes

If you choose to work with a crypto tax software, it will handle most things automatically, but you can never trust software 100%. There’s a popular crypto saying – “don’t trust, verify.” So, here are some of the most common mistakes that you need to avoid when filing your crypto taxes, especially if you do it manually.

Failing to report all transactions

Mistake: Many of you may assume that you only need to report transactions from centralized exchanges or that you only need to report buy/sell transactions.

Why it matters: Tax authorities have started tracking blockchain activity and may (or may not) already have data from exchanges themselves. Missing trades and transactions can trigger audits.

Tip: Basic crypto tax software features include automatic imports of all wallets and exchanges and categorizing transaction types.

Misreporting taxable events

Mistake: Not all events are taxable, as we’ve explained above. Many users report transfers between their own wallets as taxable events, which skews the numbers.

Why it matters: Moving crypto between your wallets isn’t considered a sale – it’s just a transfer. Reporting it incorrectly can easily inflate your payable taxes.

Tip: You can tag wallet-to-wallet transfers in most crypto tax tools, as well as in many centralized exchanges and Web3 wallets.

Not reporting staking, mining, or income from airdrops

Mistake: Many users do not account for rewards received from staking, mining, or airdrops.

Why it matters: These are taxable events, and proceeds from them are counted toward your income. Therefore, authorities levy an income tax on these funds (check sections on US and UK taxation).

Tip: Even if you haven’t sold the proceeds from these activities yet, record their market value at the time of receipt.

Not accounting for transaction fees

Mistake: If you are an active trader, failing to account for transaction fees is a grave mistake. This is also true for network fees when you engage in DeFi.

Why it matters: Transaction fees stack up incredibly quickly, and failing to account for them directly inflates your taxable income. You can discount it with the fees you’ve paid.

Tip: When you export CSVs from centralized exchanges, you must absolutely calculate the fees tab. If you are engaged in DeFi, there are fee-checking tools that will tell you how much you’ve paid in gas – attach that to your reports.

What’s New for Reporting Crypto Taxes in 2025-2026?

Right off the bat, in 2025, the IRS, as well as the HMRC and most international regulators, will continue treating cryptocurrency as property, not as a currency.

However, there are some new forms to keep in mind.

Form 1099-DA

From January 2025, crypto exchanges (and brokers) must issue a new form – Form 1099-DA. It reports gross proceeds from digital asset sales and exchanges.

From January 2026, the Form 1099-DA will also require reporting of cost basis, making the accuracy of calculations even more important.

Broker-Reporting Requirements in DeFi Repealed

In April 2025, President Trump signed a bill into law, which nullified the requirement for certain DeFi platforms to have to act as “brokers” and to report transactions to the IRS under the previous rule.

Frequently Asked Questions

How do I answer the crypto question on Form 1040?

The question:

“At any time during 2024, did you: (a) receive (as a reward, award, or payment for property or services); or (b) sell, exchange, or otherwise dispose of a digital asset (or a financial interest in a digital asset)?”

If you’ve earned crypto income, disposed of a cryptocurrency or received crypto as a gift, you should answer “Yes.”

Answering “Yes” will not necessarily increase your tax liability or risk an audit. The IRS is asking this question mostly to gather information. However, if you lie (intentionally), this is considered tax fraud.

Should I receive any forms from my exchanges?

Yes, starting in 2026, centralized exchanges are required to issue Form 1099-DA, which reports your capital gains and losses from cryptocurrency. The same copy is sent to the IRS.

Do I need to report my capital loss?

Yes, in addition to your capital gains, you should also report your losses – both short-term and long-term. This is done on Form 8949.

Do centralized exchanges like Coinbase report to the IRS?

Starting 2026, all cryptocurrency exchanges in the United States will be required to issue Form 1099-DA and send it to the IRS. The form reports capital gains and losses.

Do I need to report crypto under $600?

Yes, you are required to report all of the taxable income on your tax return. However, in most cases, exchanges will only issue Form 1099-MISC for crypto income if you’ve earned more than $600.

Do I need to report crypto on my tax return?

Yes. In the US, crypto is subject to regular income and capital gains tax.

Conclusion

Crypto taxation is no longer the wild west, and while there are still some uncertainties, major jurisdictions expect taxpayers to fulfill their obligations thoroughly. Those who fail to comply with tax obligations are audited and subject to fines.

Understanding the process in-depth and getting used to the specifics can save you a lot of time and even money. Make sure to familiarize yourself, especially if you are serious about your crypto investment or trading journey, so that you don’t end up having to deal with month-long audits and potentially devastating fines.

The post How to File Crypto Taxes in 2025: Complete Step-by-Step Guide appeared first on CryptoPotato.