The primary cryptocurrency, which was underperforming earlier today, took another turn to the upside with its price soaring from under $109,000 to nearly $114,000 in a matter of hours.

The impressive green candle comes shortly after the Federal Reserve’s meeting, during which the central bank revealed it was looking into “payment accounts” that would grant crypto and fintech companies access to Fed payment rails.

BTC’s resurgence also occurs after gold finally stopped rallying. Multiple analysts on X spotted the downtrend of the yellow metal, arguing that capital is now rotating towards the leading digital asset.

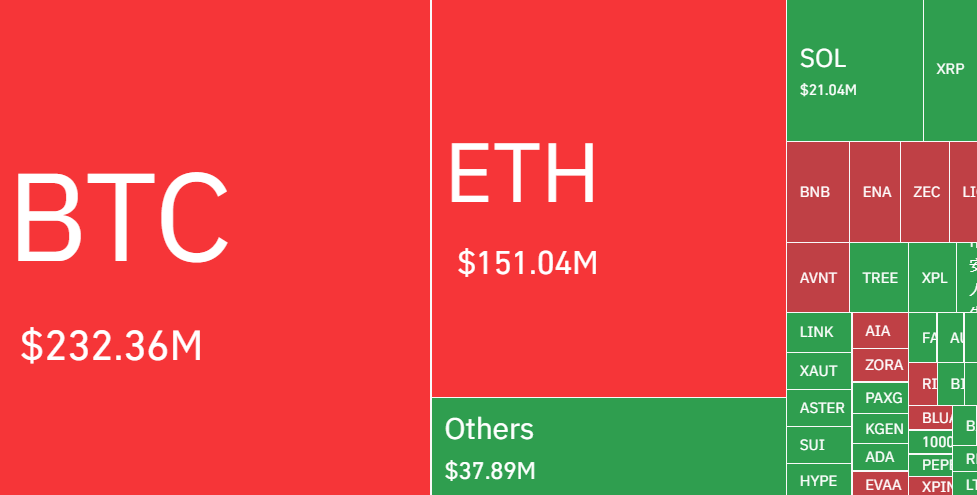

Somewhat expected, Bitcoin’s revival negatively affected traders who had previously opened too risky positions with high leverage. CoinGlass’ data shows that total liquidations on a 24-hour scale have soared to roughly $556 million. BTC trades accounted for $232 million of that amount, whereas those involving Ethereum added $151 million.

Overall, more than 140,000 traders were recked due to the market pump. The biggest single liquidation occured on the decentralized platform Hyperliquid, involved the trading pair BTC/USD and was valued at $14.45 million.

The post Bitcoin (BTC) Explodes to Almost $114K, Leaving $550 Million in Liquidations appeared first on CryptoPotato.